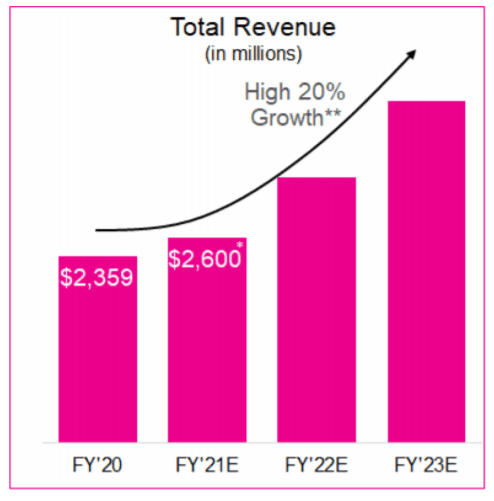

The combination of both revenue and EPS growth should fuel its share price higher in coming years.Ī way to play long-term growth in SPLK is by using longer-dated out-of-the-money call options. EPS declines look to have bottomed though over the last year and are headed higher.

As with many growth companies, profits are elusive at first. What is seen on the chart is that revenue has expanded very quickly, roughly tenfold from 2012 to present day. Below is a chart of SPLK's revenue and earnings per share over the last few years. The group will use SPLK as its nerve center for security, providing insights across the entire organization.Ĭollectively, SPLK continues to use its services across a number of fields, signaling that major growth potential in coming years. In an unrelated industry, Daimler (DMLRY), the German automotive group, signed a multi-terabyte deal to replace its legacy SIEM with Enterprise and ES. Projects won are becoming more complex and highlighting SPLK's future potential as well as growth outlook into new industries.ĭuring the quarter, SPLK won business from the Smithsonian Institution, who upgraded its use of its services to improve threat detection and mitigation across its world-famous museums and research centers.

Over the last quarter, international operations represented 24% of total revenues, consistent with previous levels and comparable on a year-over-year basis.Īn interesting aspect of the company's earnings calls are the anecdotal discussions of projects won over previous quarters. The company also had steady international success recently. Growing cloud orders is a positive sign for this business as it continues to expand its higher margin operations.

Splk seeking alpha update#

We'll update you on the full year ASPs once the year is complete, but I expect we'll be on track to our fiscal 2020 annual ASP target." "Consistent with adoption overall, in Q3, the ASP for the 581 orders greater than $100,000, which includes two of the largest cloud transactions we've ever recorded, was the highest in our history, reflecting continued value delivery from our platform. Management also had this to say about new business: Over the quarter, SPLK added more than 450 new customers, recording 581 orders over $100,000. Management has continuously stated that the key to long-term growth is customer success remaining its top priority and adoption of its platform. Growth in all regions drove both its performance and share price higher following the release of its results.

Splk seeking alpha software#

Cloud revenues totaled $24.4 million, and overall software revenues, which include license and cloud revenue, grew 34% year-over-year.

Total billings came in at $382 million, up 38% over last year. In its most recent quarter, SPLK generated revenues totaling $329 million, a 34% increase over Q3 of last year, according to management. SPLK has had a lot of success generating returns for shareholders in recent quarters as it both improves overall operations as well as wins new projects. Source: Trading View Fundamental Narrative SPLK is a quickly expanding growth company that is beginning to hit its stride, and for this reason, investor sentiment should persist, leading its share price higher. Should the stock continue higher and break out of its current consolidation on solid fundamental backing, its share price could run past $100 in coming years based on its current volatility profile. On its monthly chart, SPLK is emerging from a multi-year base pattern consolidating between $40 and $75. On its daily chart, the stock looks to be trending higher at a steady trajectory. Both its short- and long-term price action looks very strong with positive investor momentum.Īfter a number of analyst upgrades the past few months, SPLK has jumped nearly 25%. Below is a chart of both its daily and monthly time frames. SPLK's share price is emerging from a large base pattern and could run significantly higher in coming years on strong fundamental growth. An interesting way to play the long side of SPLK is through buying long-dated, out-of-the-money call options.

Its fundamental operations are improving, winning new business while growing both its top- and bottom-line. Its share price has trended sideways for much of the last few years but is finally beginning to break out higher. Splunk ( NASDAQ: SPLK) is breaking out of a multi-year consolidation pattern on strong fundamental support.

0 kommentar(er)

0 kommentar(er)